|

StatWizards LLC |

||

|

May 14, 2018 Issue |

||

|

CEOCFO MAGAZINE |

||

|

|

||

|

Q&A with George Boomer, Founder and CEO of StatWizards LLC providing Consulting, Education and Excel add-ins and Upgrades for quick and easy Econometric and Fader-Hardie Forecasting Models |

||

|

Founder & Chief Executive Officer

StatWizards LLC

Interview conducted by:

Lynn Fosse, Senior Editor

CEOCFO: Mr. Boomer, what was the vision when you started StatWizards®, LLC? Mr. Boomer: Earlier in my career I became familiar with just how powerful a number of academic tools were for making business decisions. During that time most of the tools were in the province of academia, yet after engaging in a number of consulting projects using these tools, I finally realized that there would be some value in writing software that would make these tools more accessible to businesses. As a result, I planted one foot in academia and one foot in business. Bridging the gap between the two became my calling. Ever since, I have been writing software that makes it easier for businesses to use these powerful tools. Along the way, because I was a programmer when I first got out of college, I chose Excel as a platform, because it’s the lingua franca of the business world. Almost everyone has a copy of Excel, and almost everyone is familiar with using Excel. The idea was to try not only to use Excel to make these tools accessible, but accessible in a way that makes them as easy to use as possible. I am still headed down that path, even though I am an old guy now. Our philosophy hasn’t changed.

CEOCFO: What is it about academic tools that makes them different and more effective? Would you give us an example of where they crossover? Mr. Boomer: The appreciation for academic tools first came about when I applied a technique called discrete choice modeling, developed back in 1969 by Dan McFadden at UC Berkeley, to an actual business problem. Dan’s work won him the Nobel Prize for Economics in 2000. I used his tools in some initial consulting engagements, in part as an experiment. One customer at the time was Southwestern Bell. We wanted to crack some of the big issues they faced, so we turned to Professor McFadden’s methodology for a solution. The company had some excellent researchers familiar with the technique, so we worked in tandem to produce results that excited both of us.

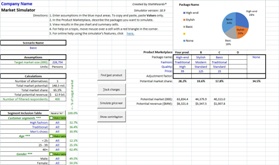

Discrete-choice methodology involves first surveying people to ask what choices they would make or have made among an array of options, then using Dr. McFadden’s statistical technique to analyze the results. You can ask people about the choices they have made either in the past or would make from hypothetical store visits. The answers ultimately become a model that estimates the probability of choosing among a set of alternatives. The model becomes imbedded in an Excel-based simulator, which lets you take different products, either in an existing marketplace or in a hypothetical marketplace, and get a sense of how potentially attractive those products would be. As you can imagine, this is enormously powerful. These simulators let users set up a hypothetical marketplace in Excel and assess each product’s potential. For example, if you have an existing marketplace and there is a potential for the entrance of a new product, you could see what potential market share the interloper would likely obtain and from where it would come–whether it could come from new people who would be entering the market or whether it could come at the expense of other competitors in the market. For a long time I developed those simulators by hand. Once I got the idea of writing software to generate them I wrote code that would create these Excel simulators using other Excel workbooks. In essence we have software writing software. The resulting simulators could be handed license-free to a project manager or anyone else interested in doing some kind of competitive analysis or pricing strategy. These simulators help position and price a company’s products in a competitive marketplace.

Over the years discrete-choice methodology has evolved from Dan McFadden’s work, and the types of models have now burgeoned to about a dozen. They are all a little bit different, some with quite different approaches. What I have done is to accommodate all of these variations and let people choose whichever technique they want, but at the same time make things easy. Best practices are embedded in the software as defaults, so users don’t need familiarity with the literature or current research. I am always trying to make the software both the best of its kind and also the easiest to use.

CEOCFO: Does the academic background matter? Do people care where they are getting or what the background is on the software or is it just this is a good and easy tool and we want it? Mr. Boomer: It is really a mixture of both. We have a segment of users who are academics and we have academic pricing. These customers use our software for academic research. Another segment consists of consultants who are interested in the academic underpinnings, but when they work with their clients deemphasize the mechanics. A third segment consists of business clients who are interested principally in whether or not the approach itself has some validity. They really do not care about how the technique works, just as most people do not care about looking under the hood of a car. Business customers just want to make sure that it works. These three segments span a range of interests, and we try to satisfy them all.

CEOCFO: Do you see people looking for something more sophisticated than Excel? Mr. Boomer: That’s a good question. I think for these kinds of simulators it’s really hard to beat Excel, because you can do so many things with the program, and the learning curve is not steep. Our simulators lend themselves to customization that lies beyond the reach of packaged software. For example, some simulators let you configure hypothetical products that you know will never exist. Excel lets you customize such simulators to prevent entering products like these. And this is just a small example. I could cite many more.

Frankly, much of our business involves consulting, most often using our tool, so in some cases our customers are not even interested in having their own simulator in Excel. They just want answers, and that’s perfectly okay. I worked at McKinsey & Co. a number of years ago. During that time a colleague said something that registered with me and remains to this day. He said that you only need enough precision to get the right answer. There are a lot of business people who just want the right answer, so we try to satisfy them as well as our other clients.

CEOCFO: How are you reaching out and how do you stand out from the crowd? Mr. Boomer: I am not sure how well we do that. We use a number of things, the most important of which is presentations at conferences and the resulting word of mouth. Back when I was a little healthier, (not this year), I attended and presented at a number of conferences where we displayed our tools; in particularly conferences put on by the American Marketing Association. I also attended and presented at conferences put on by Sawtooth Software, Inc. The second company makes software that estimates one type of discrete-choice models. My software works with theirs and generates simulators from their output. They have software that creates their own simulators, so they are a unique combination of colleague and competitor. The American Marketing Association Conference that seems to be most useful to us is the annual Advance Research Technique Forum. It is a great forum that appeals to both business practitioners and academics. Both groups present at the conference, so you get a really nice mixture of what people are doing in the practical world and also of new techniques coming down the road.

The second tier of customers come through Google, our web site and, to a limited extent, social media. These are all more traditional sources of new customers, but nothing beats face-to-face contact.

CEOCFO: Are customers buying a specific solution or a set of solutions? Mr. Boomer: They all want solutions. The real issue is the form in which they want it, as I mentioned before. People are different and their interests range across a spectrum. There are those who simply want an answer and nothing else, for example, “How well is my project going to do in the marketplace?” That is all they really want, so we give them the answer. There are also those who want to really dig into the underlying methodology and go through the spreadsheets. That is fine, too. Then there are those that fall in a range in between. We try to make all of these folks happy to the extent we can.

CEOCFO: What is it that you are selling? Is it a license to unlimited usage? Is it a number of different solutions? Mr. Boomer: We sell two principle items. One is the software itself. All our programs are Excel add-ins that you license from us. These are all perpetual licenses, but we also offer upgrades, because we are always improving the product, and we charge an annual upgrade fee for this. While a license is attached to a specific computer, our software creates additional Excel Workbooks that can be distributed license-free. For example, our simulators can be created by consultants then handed over to their clients, who in turn can use, copy and modify them at will.

CEOCFO: How do you help a company understand what to put in to get the results? What are the nuances and how do you help in that arena? Mr. Boomer: That’s a good question. The first step in applying discrete choice models is to sit down with a customer and say, “Let us take your product and break it down in to a set of product attributes.” The list can be as extensive as they want to make it. It could be price, form factor features or potential features (especially with digital products), brand, sales channels, or anything else. The list is really not limited in any way, except by the importance that these attributes have to a customer. In fact, a common first step is to have a focus group where we assemble number of customers and ask, “What are the most important things that you consider when you buy this product.” After such a a focus group and/or discussions with project managers, we come up with a list of attributes. Then we construct a set of hypothetical shopping exercises that can be presented to respondents in a survey. We design the exercises in such a way that the various product configurations we show customers are perfectly uncorrelated. In other words, the attributes themselves are completely different from one product to another. Then we send survey respondents through a set of these shopping exercises telling them, “Okay, if you were in a store and you had all of these products available to you, which one would you buy, or would you choose to buy none of these?” When the responses come back we use statistical software to convert the data into mathematical models. From that point the results go into a simulator.

CEOCFO: Would you give us an idea of what decisions a company might make after using your program? What do they recognize that they might not with a less comprehensive format? Mr. Boomer: One example has to do with Motorola. A number of years ago a group of Motorola engineers broke away from that company with the idea of launching a set of low earth-orbit satellites that would provide cellular coverage worldwide. Motorola was approached by this group to be a principal investor and backed them with around $400 million. We had done a lot of work for Motorola at that point, so Motorola suggested our names to this new group, called Iridium. The metal iridium happens to be the seventy-seventh element in the periodic charts, and their original idea was to launch seventy-seven satellites. By the time we talked to them they had spent about two billion dollars launching sixty-six of them. Launch sites were all over the world. Unfortunately, the company did things backwards. Instead of doing their market research first, they were doing it after the fact. Their marketing company told them they could sell one million units their first year. Motorola asked their spinoff to come to us to see whether that number had any validity. We put together a discrete choice survey, very much like the one that I just described, and our model projected they would sell ten thousand units the first year, which meant that this whole thing was a disaster of huge proportions. I will never forget the presentation to senior management. Their Senior Executive Vice President blew a gasket when we presented the results! He said, “You guys are dumb, you do not know what you are doing”, etc. Yet we stuck by our numbers, because we did a complete review of the research and could not find a problem. The actual number of first-year sales turned out to be less than fifty thousand. In fact, their first response was trying to sandbag the results. Motorola asked them what the results were and received no answer, so they came back to us and said, “Can you guys replicate that work?” That was one of the easiest projects we ever had! We replicated it and we basically got the same results. That was the story of Iridium. They could have saved $2 billion by doing the market research early.

CEOCFO: Everyone wants to have better results. Everybody is looking at modeling and forecasting and simulation. Why should people turn to StatWizards LLC? Mr. Boomer: For a couple of reasons. One is that we are one of the rare groups who have a foot in both the business and academic worlds along with extensive experience in, econometric and forecast modeling. We are one of the few companies with skills that span these areas. There are many consultants in this space, but because we have skills and tools that makes the process so easy and so quick, it is pretty hard to compete with us. We get universally good reviews for our consulting and software.

Aside from discrete-choice modeling, our other specialty is forecasting. We have a fair amount of experience with econometrics, as I used to work for Data Resources, Inc., at the time the most prominent econometric consulting company in the United States. A brainchild of Dr. Otto Eckstein, former chairman of the President’s Council of Economic Advisers, DRI built econometric models for the United States along with satellite models that the U.S still uses to produce economic forecasts. Working with the company for six years taught us something about how to build good models.

A few years ago we came across two brilliant academic researchers, Peter Fader of the Wharton School and Bruce Hardie of the London School of Business, who developed an innovative idea for producing forecasts. Their methodology does two things. It produces forecasts at both an aggregate level and also at an individual level. If a company can provide a customer data base with a history of purchases their customers have made, we can grind the data through Excel, generating good projections for the probabilities of which customers will make purchases, when and for how much. We can also rank their entire customer data base by the economic value of each customer to the business. Those are, again, pretty powerful things that you cannot do otherwise.

|

“We are one of the rare groups who have a foot in both the business and academic worlds along with extensive experience in, econometric and forecast modeling. We are one of the few companies with skills that span these areas.”- George Boomer

StatWizards LLC

Contact: George Boomer (619) 373-0008

|

|

|

disclaimers |

||

|

|

||

|

Discrete Choice Modeling Software, StatWizards LLC, Discrete Choice Modeling Consultants, George Boomer, Providing Consulting, Education and Excel add-ins and Upgrades for quick and easy Econometric and Fader-Hardie Forecasting Models, CEO Interviews 2018, Business Services Companies, Technology Company, Financial Company, Excel add-ins, Quantitative Research, Tools and Modeling, Quantitative tools for solving critical business problems, consultants for econometric forecasting, financial modeling and market segmentation, discrete choice modeling software, Tools, Education and Consulting for Discrete-Choice Modeling, Fader-Hardie Forecasting, Simulator Wizard builds an Excel-based market simulator from a discrete-choice model, develop an experimental design for a discrete-choice questionnaire, Forecast Wizard applies Fader-Hardie models to a number of common business problems, such as understanding the composition of sales volume, calculating customer lifetime value based on recency, frequency and monetary value of purchases, projecting customer retention and attrition, forecasting sales based on trial results, predicting online behavior and improving marketing campaigns, StatWizards LLC Press Releases, News, twitter, facebook, linkedin |

||

|

|

||