|

|

Monarch Bank (MNRK) |

|

|

CEOCFO Current

Issue |

This is a printer friendly page! Monarch Bank, a locally owned and independent

community bank, is a responsive customer-oriented bank providing exceptional service and

building lasting relationships to individuals and businesses Monarch Bank (MNRK-NASD) a community bank

headquartered in Chesapeake, Virginia, was founded to fill the need for a responsive

customer-oriented bank which provides superior service to individuals and businesses in

the South Hampton Roads Community (Southeastern Virginia). Monarch Bank is sensitive to

the needs of the community and as a locally owned and independent community bank, they

respond quickly and directly to their customers. The company takes its commitment to the

community seriously and believes that they have the experienced staff and technological

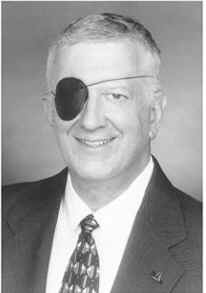

resources needed to deliver a comprehensive array of financial products and services. “The typical customer is a small to mid-sized business.”

Offers Mr. William F. Rountree, Jr., President and CEO of

Monarch Bank, “Flexibility, personal service, knowing the local

market and having locals dealing with locals has been our formula. We also have Private

Banking which deals with professionals and corporate executives. We do have some special

products we work with, especially in Private Banking. One of the neat things we have done

in our Private Banking is exclusive partnering with a concierge service. When a new client

joins our private banking group, they immediately can take advantage of those concierge

services. Our employees are also offered the same concierge service. We have drycleaners

coming to the bank, and picking up peoples laundry and then bringing it back.”

Pointing to what the Bank has done to enhance its position during recent economic

turbulence, states, Mr. Rountree, “During

the last two or three years, we have been working to develop sources of “other income”

such as our residential mortgage company, Monarch Home Funding. We now have our own

investment company called Monarch Investments. We have an insurance company, Bankers

Insurance, that we own with 28 Virginia community banks. We have just acquired a

commercial mortgage company.” Addressing investors Mr.

Rountree says, “Investors should know that we are well

positioned for interest rates when they start to rise. The balance sheet is very asset

sensitive with almost 60% of our outstanding loans rate-sensitive. The other thing that

investors do not know about Monarch is that we were posed for the future as far as “other

income”. Starting our bank at a time when rates were at historic lows has helped us

because I feel that if we can make money in this environment, then we can succeed in just

about any environment. The last thing is that we are fanatical about loan quality; we have

no loans that are ninety days past due, no-non accruals and no charge-offs. Since our

inception of April of 1999, we have only had one charge off and that was $500 dollars!” Monarch Bank is committed to providing quality

service to businesses and individuals. They offer a full range of banking services for

both consumers and businesses. With the latest in bank technology, they offer on-line

internet banking, check imaging, 24-hour telephone banking, commercial courier service,

customized loan and deposit products, debit cards, merchant bankcard services, safe

deposit boxes, automated teller machines and many other traditional banking products and

services. When it comes to banking services for

your business, Monarch Bank understands that "one size doesn't really fit all."

Your business has different goals and financial needs than other companies. So whether

you're large or small, just getting established, or have been in business for many years,

Monarch Bank has custom products to help you reach your goals. All services are designed

to grow as your business grows. Monarch Bank offers a variety of personal banking deposit

accounts to meet your individual needs: regular and interest checking accounts, statement

and money market savings, certificates of deposit, and IRA's. All deposit accounts are

insured up to $100,000 by the FDIC. |

|

To view Releases highlight & left click on the company name!

|

|