|

JUNIOR GOLD STOCK |

|

|

2010 |

||

|

The Most Powerful Name In Corporate News and Information |

||

|

Energy | Resources | Capital Goods | Healthcare | Financial | Technology | Communications | Business Services |

||

|

CURRENT ISSUE | COVER ARCHIVES | INDEX | CONTACT | FINANCIALS | SERVICES | HOME PAGE |

||

|

ICS Copper Systems Ltd Acquires 100% Of Excelsior Springs Goldmine In Nevada |

||

|

Jr. Oil & Gas

DBRM

Jr. Gold AEX

Drug Development BPAX

Health & Wellness

SMEV

Insurance MIG

Technology ANDR

Business

Services PRGX

Canadian Resource LAT

|

Mr. Chisholm is an Associate of the Chartered Institute of Secretaries and Administrators (Canada, South Africa and Zimbabwe) and has over 35 years experience in executive management, fifteen of which were in financial management including a four year expatriate contract as Group Financial Executive of the Mobil Oil agency in Swaziland. Mr. Chisholm founded Industrial Copper Systems Ltd, one of the largest importers of copper tube into Canada during the period 2000 to 2005.Industrial Copper subsequently installed and produced copper and cobalt at a pilot plant in DRC in 2005. Mr. Chisholm went on to found ICS Copper Systems Ltd, a publicly traded company on the TSX Venture exchange. (ICX: TSX.V).

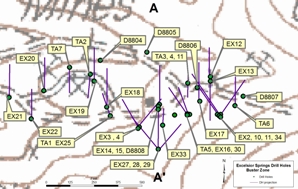

Mr. Chisholm: The focus today is our Nevada project, the Excelsior Springs Goldmine. ICS Copper Systems is a small Canadian listed TSX Venture exchange company with 32 million shares outstanding. This is the type of project that we like. 53 holes have been drilled on the property to date , it has great potential with an existing strike length of about 1000ft with potential to expand to about a mile, it was a past producing mine, and the Nevada area of course has had great success in the past, certainly the right country in which we would like to be situated.

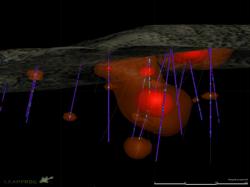

CEOCFO: What is happening today on the ground? Mr. Chisholm: I would like to back up a bit and give some history on the property. With over 53 holes being drilled there is a lot of digital data available including a 3D drill hole graphic and we are currently preparing a 43-101 report on the property. Over 36,000 tonnes of material has been removed from the site, grading just over one ounce per tonne. 26,000 tonnes of that was taken down to the Pigeon Springs mill, which was developed and they left behind roughly 10,000 tonnes of material in and around what we call the Buster Shaft and the Upper Shaft. What we want to do on the ground is to go in first of all and check this out, establish the tonnage and grade and also check out the tonnage and grade of the tailings at the Pigeon Springs mill. Then I think the second step is to have our Technical Committee, led by metallurgist and Director Larry Treadgold, and assisted by geologist Dave Wolf, determine what the best course of action for ICS is. Do we continue with the drill program into the oxide or do we sink a deeper diamond core hole into the gold porphyry deposits, or do we have a look at the viability perhaps of a small heap leach using the material that is in and around the existing mines.

CEOCFO: Were you specifically looking for a gold project or was it opportunistic? Mr. Chisholm: Given the fragile state of the world economy, the fact that American debt both personal and federal is $11 or $12 trillion in excess of America’s current GDP, obviously the concern is the fragility of the world economy. Obviously, the Keysian supply side economic package introduced under the Obama government hasn’t translated into employment and job creation. So we are seeing a slower moving economy that is affecting the rest of the world. We are also seeing increasing instability in that China is doing major deals avoiding the US dollar. So we believe that the US dollar will come under more pressure, and in a global world where uncertainty is the norm, fragility is the norm, and given that we are massively overpopulating the planet; today six billion is predicted to be ten billion by the year 2050, we believe that gold is going to be one of the last havens and refugees for quality money.

CEOCFO: Would you give us a sense of the history of management? Mr. Chisholm: Mark Janser, who is our lead director is ex-UBS (Union Bank of Switzerland) specializes in management, strategic planning, corporate deals, corporate financing, and corporate structure. Larry Treadgold is a world class metallurgist and has been in and around gold for many years. He was with Nickanor in DRC, which raised 400 million pounds in 2007. He is a gold expert with significant metallurgic expertise and we are very pleased to have people of this quality on the team together with a range of consulting geologists like Dave Wolfe, and the advices of our QP (qualified person) Ken Brook. Dave Wolfe in particular has been directing geological work at the Excelsior mine over the last 5 years so his advices will be valuable.

CEOCFO: What is the financial situation for ICS today? Mr. Chisholm: We have sold $1.5 million worth of assets and the first tranche of USD $200,000 has been banked. Therefore, we are in a pretty good financial state at the moment. So we are happy with cash in the bank, a clean balance sheet and, we think, a very exciting project.

CEOCFO: So you are ready to go? Mr. Chisholm: We are ready to go.

CEOCFO: How do you reach out to potential investors? Mr. Chisholm: Typically, in the past we never have done this job well, reaching out to potential investors. Yes, we have met with brokers, we have different IR friends that approach us, but you never really know which ones are going to give you the best bang for your buck. We have had the experience where we paid good money and received poor feedback. So we actually stay with contacts within the industry and word of mouth. However, we may look at some kind of IR work down the road if we find a suitable partner.

CEOCFO: In closing, address potential investors, there are many resource companies to choose from; why does ICS stand out from the crowd? Mr. Chisholm: ICS Copper Systems should stand out from the crowd because we have hands-on expertise and have a past history of small scale production of copper so we have in house metallurgical expertise. This means that we can possibly go to early cash flow from a small heap leach operation. So yes, small company, the niche that we have is a good fit within the company to create small cash flow within a short term period.

|

From The Exploration And

Production Of Lithium To Partnering For Manufacturing, Lomiko Metals

Inc. Is Developing Into A Fully Integrated Battery Company |

|

Access thousands of full-text Public

Company CEO & CFO Interviews!

|

||

|

|

||

Interview

conducted by: Lynn Fosse, Senior Editor, CEOCFOinterviews.com, Published –

October 1, 2010

Interview

conducted by: Lynn Fosse, Senior Editor, CEOCFOinterviews.com, Published –

October 1, 2010